- posted: Aug. 06, 2019

- Personal Injury

In personal injury cases, addition to past economic losses, consideration must be given to the possibility that the Plaintiff will suffer future economic losses as well. Often, particularly in the case of younger Plaintiffs, these future economic losses may represent the majority of the Plaintiff's total damages.

Those future damages, whether they be medical, vocational, or special needs, generally must be described by an expert, such as a physician, vocational rehabilitationist, or life care specialist.

Moreover, in medical neglect cases, Section 538.215, RSMo. requires that future damages be expressed at present value.

Both concepts, future damages and the present value thereof, are joined closely and both are addressed here.

As mentioned, in order to accurately assess economic future losses, a formal evaluation must be completed by medical, vocational, or other experts. Based on these evaluations, experience shows that certain assumptions can be readily made:

- People who have permanent injuries continue to require future medical treatment for the remainder of their lives since these injuries aggravate or accelerate the normal aging degeneration process;

- People who have permanent injuries are unable to remain in the workforce as long as those uninjured; and

- People who have permanent injuries are unable to perform all necessary tasks required to keep up a household; and

- Some permanent injuries create special needs within the lifestyle of the Plaintiff to accommodate for disabilities.

In essence, experts generally acknowledge that permanent injuries often have damage consequences that extend into the future, as well as the past.

Further, experience reveals that, given reliable foundational data (usually from U.S. Government sources), experts can calculate future damages with a degree of reasonable certainty sufficient to justify admission of the calculations into evidence at trial.

Economic Evaluation Data

Foundational information to calculate future damages includes:

Life Expectancy - Missouri Courts will take judicial notice of the mortality tables presented in Volume 42 of Vernon's Annotated Missouri Statutes. The statistical data from which those tables are draw is somewhat dated (1930-1940 for the most part) and, given that life expectancy has increased significantly in the last 80 years, many experts use other up-to-date resources. For example, the US Department of Labor, Bureau of Labor Statistics, Statistical Abstracts of the United States publishes a table entitled Expectation of Life and Expected Deaths By Race, Sex and Age which is commonly used by experts to express a Plaintiff's life expectancy.

Growth Rates - With the passage of time, the cost of any given item will increase, with very few exceptions. Growth rates vary based on the commodity under consideration, with wages growing at a different rate than medical commodities or the general price of consumer goods. Those considered here are:

- Wages - By way of example, the Economic Report of the President Table B-15 shows that private non-agricultural wages have increased annually from 1952 - 2017 at an average rate of 4.20% annually. Additionally, some sources provide real world examples of how wages increase. For example, the Missouri State Manual, published by the Missouri Secretary of State, shows that in 1953 the Governor of the State of Missouri was Phil M. Donnelly who, according to the Missouri State Manual, was paid an annual salary of $10,000. In the latest Missouri State Manual, the current salary for the Governor is $133,821.

- Household Services - Missouri recognizes that each person=s contribution to a household is of value, and the loss is compensable. According to the Economic Report of the President, the general Consumer Price Index (the Consumer Price Index has many sub-components), which reflects the cost of such general items as household services and minimum wages, has from 1952 - 2017 increased annually at the average rate of 3.48%.

- Medical Price Index - Medical good and services have grown, on the average, at different rates than other consumer products and services. According to the Economic Report of the President, the Medical Price Index generally shows an annual rate of increase from 1952 - 2011 of 4.81%. It should be noted that out-patient medical services, in-patient medical services, and medical prescription drugs increase in cost at different rates.

- Specialty Goods and Services - Some injuries create a need for specialty goods or services. For example, burn victims may require special HVAC units in their homes. Paraplegic victims may need special vehicles or special stairway lifts. The cost of some of these items may increase annually at the rate of the general Consumer Price Index, while others may show increase rates closer to the Medical Price Index. Experts conducting an evaluation will estimate the growth rate based on the specific special needs on a case-by-case basis.

Wage & Earnings - Future loss of earnings is often a significant component to the Plaintiff's damage considerations. Experts must consider:

- Loss of Earning Capacity - Loss of future earning capacity may be an issue if the Plaintiff is no longer employable in their chosen profession. Plaintiffs may incur the expense of vocational rehabilitation to re-train into a comparably paying alternative profession, and some Plaintiffs simply may not be able to earn as much as they did pre-injury.

- Loss of Work Life Expectancy - It is well recognized that people with permanent injuries often cannot remain in the work force as long as those who are uninjured. Vocational experts may estimate that the Plaintiff may lose some years of work life expectancy from the end of their anticipated career. The US Department of Labor, Bureau of Labor Statistics publishes a report entitled Special Labor Force Report, Length of Working Life For Men and Women, as well as a bulletin entitled Worklife Estimates: Effects Of Race & Education. Vocational experts may make use of the current statistical data in both when estimating loss of work life expectancy.

- Fringe Benefits - In addition to cash compensation, employees receive a significant portion of their compensation in the form of non-cash fringe benefits. These can include health insurance, pensions and savings, vacation, sick leave, workers compensation, social security matching (over 6.2% alone), and other benefits. The Statistical Abstracts of the United States, Tables 684 and 660 show that from 2005-2014 the average American worker received, in addition to cash compensation, fringe benefits amounting to an additional 31.6% over and above his or her cash salary.

- Current Income - Experts must consider the current earning capacity of the Plaintiff. Salaried workers are straight-forward but, if the Plaintiff is self-employed, experts must consider the profitability of the Plaintiff's business, and show a loss of either income stream or loss of profitability (if costs were increased). For example, a small business owner may suffer a reduction of income stream, simply because they are unable to work as much or may only be able to work on lower paying jobs. Another example is that a small business owner may be able to sustain the same gross income stream, but must hire additional workers to do so and thereby increase costs (lowering profitability). Either way, the impact to a small business owner's income stream must be based on an adequate past history proving the profitability claimed is not merely speculative.

Future Expenses - Experts must apply growth projections to estimates of future expenses that are reasonably certain to occur:

a. Medical Goods and Services - Need for regular treatments (i.e. on-going physical therapy) or regular medication costs (i.e. analgesics, etc) in the future, based on the current costs. Also, future requirements can be estimated (i.e. a future total knee replacement) based on current costs after the applicable growth rate mentioned above is applied.

b. Household Services - As mentioned, the contributions of each family member to a household are of value and may be compensated when lost. These can include outright loss of those services, or turn on future requirements to hire third parties to perform tasks (i.e. lawn maintenance, preventative vehicle maintenance, etc), and future estimates will be based on current costs. A number of studies have been done to estimate the average contribution to household services by household members, including:

The Porter Study

The Gauger-Walker Study

The Douglass, Kenney & Miller Study

The Bryant, Zick & Kim Study

and include current value estimates for each type of contribution. Future requirements can be estimated based on current costs after the applicable growth rate mentioned above is applied.

c. Special Needs - Some injuries result in special needs. When such is the case, commonly a Life Care Plan specialist will prepare a list of on-going special needs and the current costs. Examples include physical or speech therapy, home environment modifications, technology aids, transportation modification, physical aids, etc. Each case is different, and not all Plaintiffs will require special needs. Future requirements can be estimated based on current costs after the applicable growth rate mentioned above is applied.

Based on this data, medical, vocational, and economic experts can estimate the cost of future economic losses with sufficient certainty that the projections will be admitted into evidence for a decision by the jury.

Present Value of Future Economic Losses

In estimating the amount of future economic damages in medical neglect case, an additional economic aspect must be considered. As mentioned, Section 538.215, RSMo. requires that future damages be expressed in terms of Present Value in medical neglect cases.

To understand present value, the first consideration is that the future damages will grow with inflation (Growth Rate). The growth rates for various damage categories are presented in the foregoing section.

To determine Present Value a second consideration to be factored in -- the Discount Rate.

In essence, Present value is the amount which, if prudently and safely invested today, would likely yield future returns that will equal the future damages in the years when those damages will be incurred. For that reason, the raw cost of grown future damages must be discounted by the investment potential if those damages were paid today, invested, and then used in the future.

Data is published in the Economic Report of the President, Table B-69, showing different investments including corporate bonds, municipal bonds, and long-term government securities. The most secure are long-term government bonds (those that do not mature for at least 10 years), which in 1952 - 2017 showed an average investment return of 5.85%.

Example

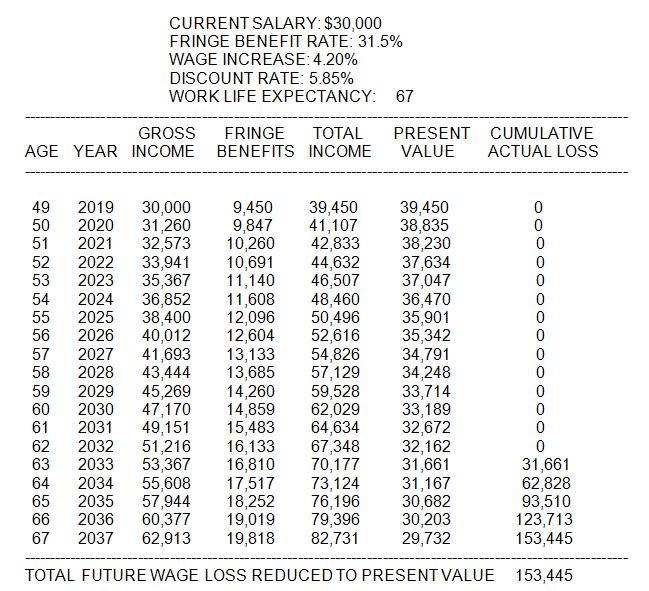

To give an example, consider a 49 year old worker in a relatively sedentary job who planned to work to age 67 (full Social Security age currently used for this example), but who suffers an injury that is projected to cause the worker to lose five years of work life expectancy and force the worker out of the work force at age 62. The worker's current salary of $30,000 per year will grow in the future at the growth rate of 4.20% (used for this example), and the worker receives 31.5% (used for this example) additional fringe benefits. The worker's earning capability can be projected into the future, with the actual losses from age 62-67 being projected by growth, and then reduced to present value by the discount rate of 5.85%. The present value calculation for this example would look (more or less) like the following:

As this matrix reveals, in a medical neglect case, if the jury finds the Plaintiff will lose five years of work life expectancy, the jury would express the present value of the last five years of the workers earning capacity as $153,445 -- even though the wage & fringe benefit loss in 2033-2037 will actually total $381,624. If $153,445 is prudently invested today, beginning in the year 2033, the investment will grow so that it can pay the actual losses of $381,624 in the years 2033-2037 when the damages actually are actually incurred.

Contact an experienced Rolla injury lawyer

A knowledgeable injury lawyer has a unique understanding of future economic losses. A knowledgeable attorney will first assist clients by referring them to the right medical, vocational, economic, and special needs experts for evaluation of whether future economic losses will occur, and for calculation of those future losses. A knowledgeable attorney will then know how to present those calculations to a jury in a clear and understandable manner.

By: Joseph W. Rigler

DID YOU KNOW ? is presented by Williams, Robinson, Rigler & Buschjost, PC as a public information service only. None of the information contained herein is intended to be taken as legal advice. Each matter depends on unique facts which attorneys must consider in forming an opinion, and may depend on laws unique to a particular jurisdiction. No two cases are the same. If you want to know more about this subject, contact Williams, Robinson, Rigler & Buschjost, PC, or the attorney of your choice, and seek a formal opinion about your particular case.

Williams, Robinson, Rigler & Buschjost, PC provides legal services in South-Central Missouri, serving Maries County (including Belle, Vienna & Vichy), Crawford County (including Cuba, Steelville, Bourbon), Dent County (including Salem, Lecoma, Bunker), Phelps County (including Rolla, St. James, Newburg, Doolittle, Edgar Springs), Texas County (including Licking, Houston, Raymondville, Summersville, Cabool), Pulaski County (Waynesville, St. Robert, Richland, Dixon, Crocker) and may provide legal service in other locations on request.